Medicare, a term often heard in discussions about healthcare for older Americans, is a multifaceted and essential program. Established in 1965, it has since grown and evolved, becoming an indispensable lifeline for millions. Whether you’re approaching the age of eligibility or assisting a loved one in their healthcare journey, understanding Medicare is crucial. This comprehensive guide will walk you through its history, the various components, enrollment procedures, costs, and more.

A Historical Glance at Medicare

In 1965, President Lyndon B. Johnson signed Medicare into law, fundamentally transforming the landscape of healthcare in the United States. Initially designed to offer health insurance to individuals 65 and older, it made healthcare accessible to millions of seniors irrespective of their income or medical history. Over the decades, its coverage expanded to include certain younger individuals with disabilities, those with end-stage renal disease (ESRD), and those diagnosed with amyotrophic lateral sclerosis (ALS).

Dissecting the Parts of Medicare

Medicare isn’t a one-size-fits-all program. It’s more akin to a modular system, allowing beneficiaries to choose components based on their needs:

- Part A (Hospital Insurance): Part A covers inpatient hospital stays, care in a skilled nursing facility, some home health care, and hospice care. Many beneficiaries do not pay a premium for Part A, given they or their spouse contributed to Medicare taxes while working.

- Part B (Medical Insurance): This complements Part A by handling outpatient care costs, including certain doctors’ services, medical supplies, and preventive interventions. A monthly premium is associated with Part B, which might vary depending on the beneficiary’s income.

- Part C (Medicare Advantage Plans): Offered by Medicare-approved private companies, these plans are an alternative to the traditional structure. They incorporate both Parts A and B and usually include extra benefits, such as vision, dental, and hearing coverage. The premiums can differ significantly among plans.

- Part D (Prescription Drug Coverage): Facilitated by private companies but approved by Medicare, Part D deals with prescription drug costs. While some beneficiaries opt for standalone Part D plans, others might find these services within their Medicare Advantage Plan.

The Enrollment Maze

Age 65 is a significant milestone in the Medicare journey. The Initial Enrollment Period is a seven-month window that commences three months before your 65th birthday and concludes three months after. Enrolling within this timeframe is crucial to avoid penalties.

However, not everyone jumps into Medicare at 65. If you’re still employed and covered by your employer’s health insurance, or if you’re covered through a working spouse, you might delay Part B enrollment. Once the employment or coverage ceases, a Special Enrollment Period activates, allowing you to sign up without penalties.

For those who miss these windows, the General Enrollment Period, from January 1 to March 31 each year, provides another opportunity. However, late enrollment penalties might apply.

Balancing Medicare with Other Health Coverage

Many beneficiaries juggle Medicare alongside other health insurance forms, like employer-sponsored plans or Medicaid. In such scenarios, ‘coordination of benefits’ rules dictate the payment sequence. When Medicare is the ‘primary payer,’ it addresses costs before your other insurance. Conversely, as the ‘secondary payer,’ it handles costs after your primary insurance has paid its share.

Understanding the Costs

Though Medicare provides extensive coverage, it’s not gratis. Beneficiaries are often responsible for premiums, deductibles, and co-payments. The specific costs hinge on several variables:

- Type of Plan: For instance, Medicare Advantage Plans might have different premium structures than original Medicare.

- Income Level: Higher-income beneficiaries might pay increased premiums for Parts B and D.

- Medical Needs: Depending on healthcare requirements, out-of-pocket costs can fluctuate.

To mitigate some of these expenses, many beneficiaries turn to Medigap (Medicare Supplement Insurance). These private insurance policies bridge the gap left by Medicare, covering additional costs like copayments, coinsurance, and deductibles.

The Future of Medicare

With an aging population and rising healthcare costs, the sustainability and structure of Medicare frequently appear in policy discussions. As healthcare technologies evolve and the needs of beneficiaries shift, Medicare must adapt. While its foundational goal remains unchanged — providing seniors and eligible individuals with comprehensive health coverage — the specifics of its operation might see alterations in the coming years.

Medicare, in its complexity, embodies the U.S. commitment to safeguarding the health of its aging and eligible populations. Although its intricacies can sometimes feel labyrinthine, understanding its structure, benefits, and costs is invaluable. As you or your loved ones approach Medicare eligibility, remember to review your needs, consult with trusted experts, and make informed decisions that prioritize both health and financial stability. With knowledge as your ally, you can navigate the Medicare landscape confidently.

Image Credit: Markus Frieauff on Unsplash

Readers May Also Like:

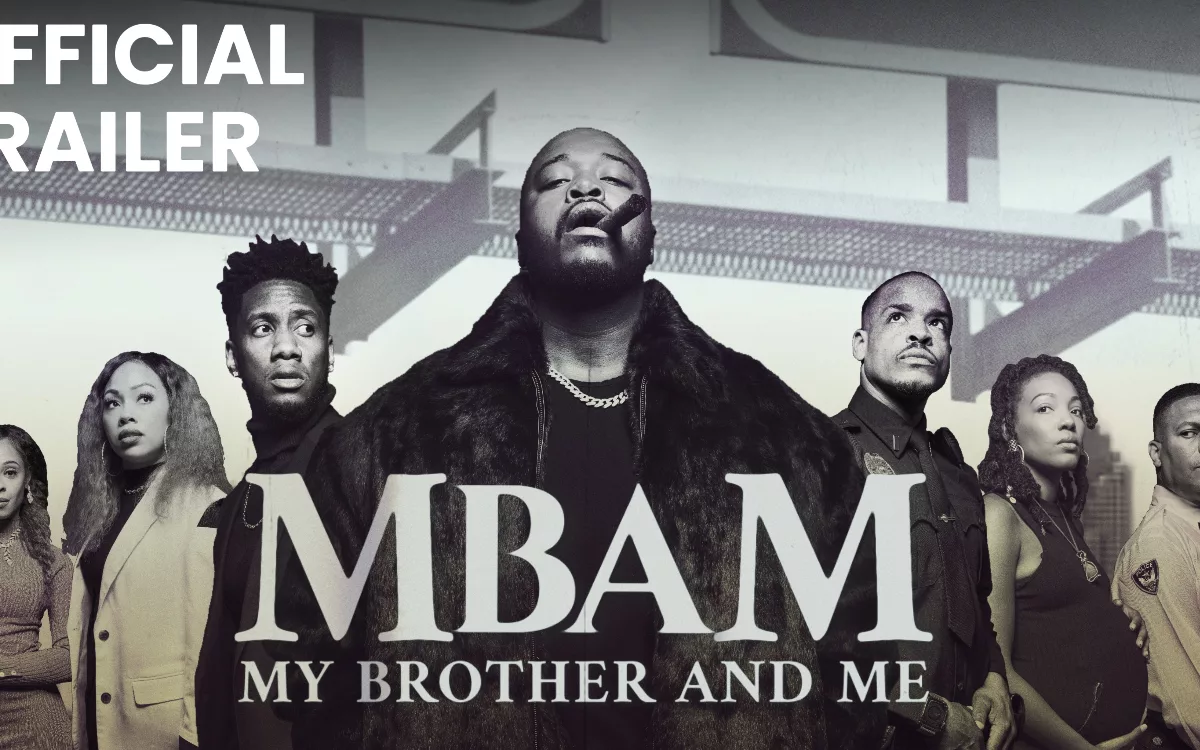

[FIRST LOOK] ‘My Brother and Me’ Given New Life With Gritty Tribute Adaptation

[FIRST LOOK] ‘My Brother and Me’ Given New Life With Gritty Tribute Adaptation

How to Cultivate Healthy Lifestyle Habits Through Education and Awareness

How to Cultivate Healthy Lifestyle Habits Through Education and Awareness

Serenity by Design: Tranquil Nature-Inspired Interiors

Serenity by Design: Tranquil Nature-Inspired Interiors

Why Incorporating Online Entertainment Can Transform Your Lifestyle

Why Incorporating Online Entertainment Can Transform Your Lifestyle