If you’re a motorcycle enthusiast, you know that having the right insurance coverage is essential. But with so many options out there, it can be tough to figure out what’s best for you. That’s why we’ve put together this guide to the best motorcycle insurance coverage.

We’ll help you understand what coverages are available and how to choose the right policy for your needs. So whether you’re a weekend rider or an experienced racer, we’ve got you covered. Let’s get started!

What is motorcycle insurance, and why do you need it?

Motorcycle insurance is an important form of coverage that protects both riders and their bikes. It can include protection against damage caused by accidents, theft, and other events beyond your control.

Depending on the policy, it may also include medical payments if you are injured while riding, as well as liability coverage in case you are responsible for any damage or injuries to others.

Submitting proof of insurance is usually required when registering or renewing a license plate, so it’s important to carry some form of insurance when owning a motorcycle.

Some states even mandate certain types of coverage, such as bodily injury liability and property damage liability. Although motorcycle insurance can be expensive, it’s important not to skimp on coverage out of fear or money concerns; without insurance, riders face tremendous financial risks should something happen during a ride.

Purchasing the right kind of policy tailored to your needs helps ensure that you’re protected legally and financially should anything occur. Motorcycle insurance can not only save you from potentially huge payouts in case of an accident but can also allow bike owners to rest easier knowing they’re covered for all kinds of eventualities that arise when rides take them away from the safety and stability of their garages.

What are the different types of motorcycle insurance coverage available?

If you own a motorcycle, it’s important to have the right insurance coverage. Motorcycle insurance provides protection for its owner against economic loss due to an accident or theft. Different types of coverage are available, depending on your needs and budget.

Liability insurance covers losses incurred if you are found responsible for another party’s property damage or personal injuries in an accident that involves your motorcycle.

Comprehensive coverage provides protection against vandalism, theft, fire, and other unexpected circumstances that could cause damage to or the replacement of your bike.

Collision coverage will pay for repairs when the bike is damaged in an accident involving another vehicle or object, regardless of who was at fault.

Uninsured/underinsured motorist (UM) is additional liability coverage should you be in an accident that involves an uninsured or underinsured driver, while personal injury protection (PIP) will cover medical expenses, including lost wages and rehabilitation costs resulting from injury due to an accident with a motorcycle.

Finally, gap insurance is designed to cover the difference between what you owe on the bike undergoing repairs and what its current market value would be if it were totaled after an accident.

With this range of options available, there’s sure to be something that fits every motorcyclist’s unique needs and concerns when it comes to selecting their motorcycle insurance.

How much motorcycle insurance coverage do you need to be safe on the road?

No matter how experienced a motorcycle rider you are, insurance is a vital part of safe riding. Without the right coverage, you can be on the hook for exorbitant medical costs if you are involved in an accident and without any protection from certain kinds of damages, such as theft or vandalism.

When deciding how much insurance coverage to get, factors such as where you ride, your bike’s MSRP (manufacturer’s suggested retail price), and any modifications you have made should all be taken into consideration.

Every state has set minimum requirements, which vary but typically provide protection for different types of damages, including personal injury and property damage liability. Beyond that, riders may want to think about buying comprehensive coverage, which will cover accidental damage to your own bike, personal injury protection to cover medical expenses after an accident, and more.

Ultimately, it pays to take some time researching what type of motorcycle insurance is best for your situation so that you’re as safe and secure as possible when out riding your two-wheeled steed.

The answer is not one-size-fits-all; instead, it’s important to know both your state’s requirements and what kind of additional coverage might make sense for how much time and how far you ride each year. With the right prep-work done prior to hitting the road, it’s possible for every rider to stay safe out there with the added security of a robust policy.

Readers Might Also Like:

[FIRST LOOK] Meet the Cast of ‘Riches’ Season 1 on Prime Video

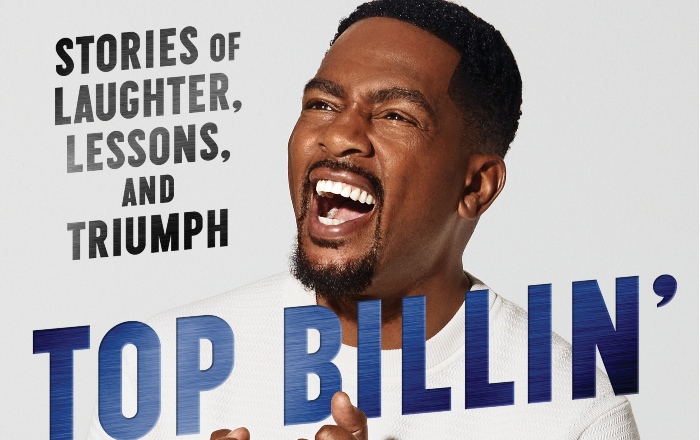

Bill Bellamy To Release Debut Memoir, “Top Billin’: Stories of Laughter, Lessons, and Triumph”

[FIRST LOOK] ALLBLK’s New Series, ‘Hush’ Stars Joyful Drake, Erica Mena & More…

![[FIRST LOOK] Meet the Contestants of Amazon Freevee's 'America's Test Kitchen: The Next Generation'](http://parlemag.com/wp-content/uploads/2022/11/FIRST-LOOK-Meet-the-Contestants-of-Amazon-Freevees-Americas-Test-Kitchen_-The-Next-Generation.jpg)

[FIRST LOOK] Meet the Contestants of Amazon Freevee’s ‘America’s Test Kitchen: The Next Generation’, Hosted By Jeannie Mae Jenkins