There is a dirty little secret in the world of credit cards that the banks would rather you didn’t know. Visa and MasterCard and their large banks, have what is called market power, and they abuse this market power to control payment card markets to impose a private “tax” called an “interchange fee” that consumers must pay to card-issuing banks through merchants on all their credit and debit card transactions. American consumers pay more than we should for virtually all our retail purchases, and the less well-off we are the more we are likely to be overcharged.

“Because Visa and MasterCard prohibit merchants from recovering this hidden tax directly or effectively steering customers to less expensive forms of payment, this tax on merchants (reportedly in excess of $48 billion per year and growing) becomes a significant part of the prices all consumers pay for goods and services.” (Electronic payment systems and interchange fees; Albert A Foer, 2010)

The Big Banks Secret is that every time that you purchase something you are paying your share of the $48 billion “tax” going straight to the banks. This “tax” isn’t just imposed on those purchasing with credit or debit cards. This “tax” is paid by everyone because the merchant is prohibited from recovering this money directly by the credit card issuing banks forcing them to pass the “tax” payment on to us in the form of higher prices for merchandise.

Incredibly while the banks are charging the U.S. consumers an extra sales tax they themselves find loopholes and tax refunds to skirt around the U.S. tax code. “The six largest banks: Bank of America, Wells Fargo, Citigroup, JPMorgan Chase, Goldman Sachs, and Morgan Stanly; together paid income tax at an approximate rate of 11% of their pre-tax U.S. earnings in 2009 and 2010, instead of the 35% that they are legally mandated to pay the federal government. Shorting the government $13 billion in tax revenue” (Big Bank Tax Drain; Mathew Skomarovsky and Kevin Connor, 2011)

There are precedents for dealing with these kinds of unfair and illegal banking practices it’s the Big Banks Secret. “In 1913, Congress authorized the Federal Reserve to attempt to eliminate “exchange fees” that merchants were required to pay by some banks to cash their customers’ checks. The Federal Reserve adopted rules designed to ensure that all checks would exchange at par, i.e., their face value.” (Electronic payment systems and interchange fees; Albert A Foer, 2010) “The payment card networks and their banks have amassed market power not only in this country but around the world; and competition bureaus and central banks in many jurisdictions, including the European Union, Australia and New Zealand have called for either the elimination of interchange fees or their radical reduction. In virtually every case, the interchange fees in the United States substantially not only exceed the ones that foreign governments have reduced or eliminated, they also exceed the unregulated interchange fees of all developed economies.” The banking industry was still able to survive and conduct business using checks til the present day. There is no reason why we as consumers should have to pay an extra “tax” that Congress never approved, where the money goes directly to greedy banks that don’t pay their legal share of taxes.

Those of us who are working poor or middle class, are disproportionately affected by these “taxes” imposed on us because we are the ones who can least afford to pay an extra tax. At the same time the banks give their wealthier clients bonus points or bonus miles when using their cards thereby nullifying the bank’s “tax” for the wealthy card users. While the $13 billion in taxes the banks are avoiding could go to infrastructure projects creating more private sector jobs, could go to schools to rehire some of the laid off teachers, low-income projects like the Home Energy Assistance Program, Food Stamps, or Medicaid for mothers and children. “Closing special tax loopholes on the financial sector and implementing sensible revenue-raising initiatives such as the Financial Speculation Tax (which curbs short-term speculation) could generate over $150 billion in federal tax revenue each year.” (Big Bank Tax Drain; Mathew Skomarovsky and Kevin Connor, 2011)

It seems that the big banks have found a way to steal yet more money from Main Street and reallocating it to Wall Street, and because of the immense market power the banks have over the card market, there is nothing that merchants or consumers can do about it. Congress needs to step in and protect the American people from this abuse of power.

Our federal government was created to do for us what we or the states couldn’t do for us. There is an injustice here in America and it is being perpetrated on the majority of her people. We as Americans need to speak up to our Congressmen and our Senators and let them know that corporate welfare and tax avoidance can no longer be tolerated, especially in this economy, The Big Banks Secret is out. President Roosevelt had a New Deal for America in the 1930’s, where is our New Deal? We need to let Congress know that we want action, or in lieu of a New Deal, we will get a new Congress.

Readers May Also Like:

[WATCH] Cardi B Allows Tampon String To Dangle During Performance

DJ Envy Ran A Real Estate Ponzi Scheme? Investors File Lawsuit

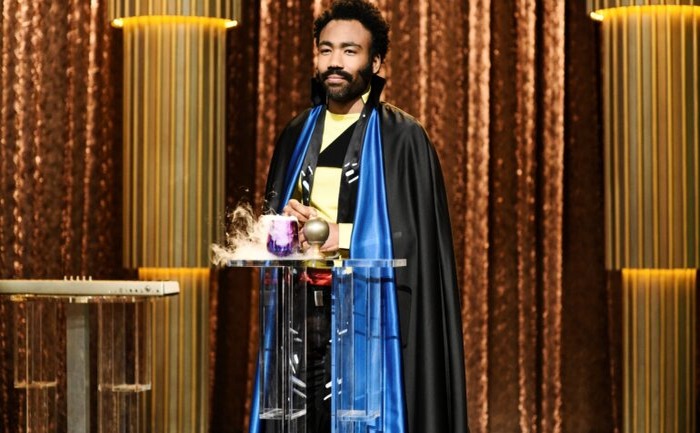

Donald Glover & His Brother Are Writing New ‘Star Wars’ TV Series?

Drake Sets Record For Highest Paid Single Arena Rap Concert